Financial Planning

Financial Planning That Puts Your Life First

At Care Financial, we help you align your financial decisions with your goals—clearly, confidently, and without the sales pitch. Whether you’re planning for retirement, managing risk, or simply getting organized, we bring decades of experience and a thoughtful, personalized approach to every conversation.

Your Future, Mapped Out

Retirement Planning

Retirement is more than a finish line—it’s a new phase of life that deserves a strategy. Whether you’re years away or already retired, we’ll help you understand your options, project your income needs, and build a plan that fits your vision.

Safe Guaranteed Growth & Predictable Income

Annuities

Annuities offer more than retirement income—they can also help grow your savings without market risk. We guide you through options like MYGAs, SPIAs, and fixed index annuities to support dependable income or safe accumulation, all within a strategy that fits your full financial picture.

Protect What Matters Most

Insurance Planning

From life insurance to long-term care, we help you put protections in place that support your family, your future, and your peace of mind. We’ll walk you through your options and show you how insurance works within your plan.

Want to See How It All Fits Together?

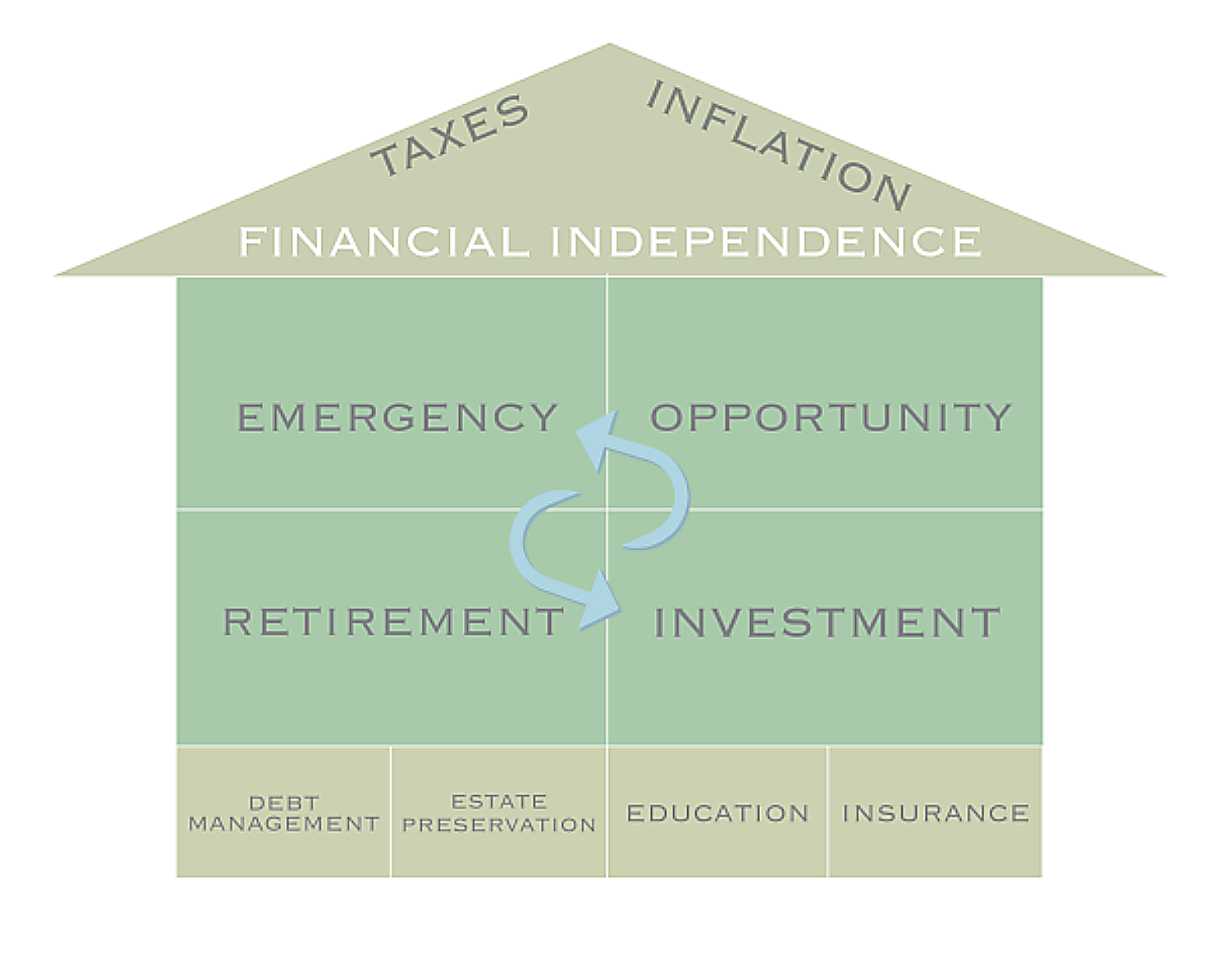

Explore the Financial House

We use the Financial House to help clients visualize how each piece of their plan works together. It’s a tool we come back to often, because it makes planning more approachable and practical. Here’s a quick breakdown:

Emergency Room

Set aside 3–6 months of income to prepare for the unexpected. This creates a strong foundation of stability.

Opportunity Room

Higher-risk, high-reward options for growth when appropriate. This is where your strategy can stretch.

Retirement Room

Strategies for income security during retirement with no risk to principal.

Investment Room

Build long-term wealth with plans that balance growth and protection.

The Roof

We help protect your entire strategy from inflation and taxation—two of the biggest threats to your financial future.